Switzerland

Poland

1%

The Netherlands

4%

Spain

13%

France

23%

24%

62%

2%

12%

2013

2014

Belgium

59%

Film distribution

2%

B2B

15%

Real estate

4%

Brightfish

4%

In-theatre

sales

21%

21%

54%

1% 4%

4%

16%

B

5

2013

Switzerland

Poland

1%

The Netherlands

4%

Spain

13%

France

23%

24%

62%

2%

12%

2013

2014

Belgium

59%

Film distribution

2%

B2B

15%

Real estate

4%

Brightfish

4%

In-theatre

sales

21%

21%

54%

1% 4%

4%

16%

2014

Box office

54%

2013

Discussion

of the Results

2014 was a year characterized by expansion. Kinepolis

entered the Dutch market, grew in Spain and

announced various new-build projects. In the course of

the year investments were also made in strengthening

the organization as part of the Group’s expansion.

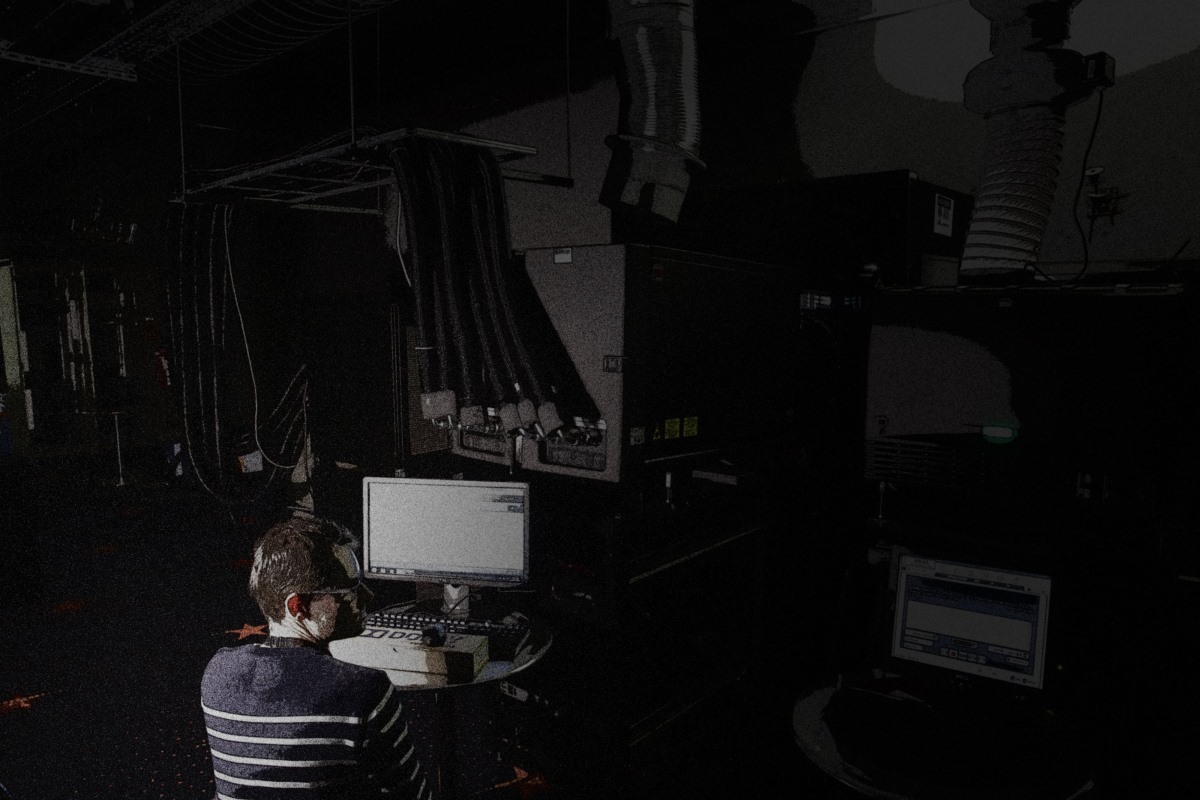

Revenue by country in 2014 vs. 2013

Revenue by activity in 2014 vs. 2013

Kinepolis welcomed 19.7 million visitors in 2014, a

rise of 8.0% compared to 2013. This increase was

thanks to the acquisition of cinemas in the

Netherlands and Spain and a good local film offer

in France and Spain. The warm weather in June

and in the autumn in Belgium and France,

together with the World Cup Football, as antici-

pated, had a negative impact on the visitor

numbers. The higher visitor numbers led to an

increase in total revenue by 6.8%. The core

activities box office and in-theatre sales per-

formed strongly. Spain’s larger share and the

sectorial price campaigns in France and Spain had

a negative impact on the revenue per visitor. Total

revenue of Brightfish rose due to higher revenue

from events, whereas lower screen advertising

revenue was generated. Film distribution and real

estate revenue increased. Business-to-business

revenue fell, due to the lower screen advertising

revenue and fewer corporate events as a conse-

quence of the World Cup Football.

REVENUE

Turnover was € 262.6 million, an increase of 6.8%

compared to 2013. Revenue did not increase in

line with the number of visitors due to Spain’s

larger share of in the total visitor number and the

decrease in revenue from screen advertising,

partly offset by the increased revenue of advertis-

ing agency Brightfish and film distribution as well

as higher real estate revenue. Revenue from ticket

sales (box office) increased by 6.8%. Revenue from

food, beverages and retail (in-theatre sales) rose

by 7.7%.

Revenue can be broken down as follows:

Box office

revenue was € 140.9 million, a rise of

6.8% compared to 2013. This increase was driven

by the expansion in the Netherlands and Spain,

offset by lower sales of 3D tickets and glasses and

lower virtual print fee (VPF) revenue. There was a

slight drop (-1.1%) per visitor as a consequence of

Belgium’s lower share and Spain’s higher share in

total box office revenue. Per visitor revenue was

also negatively impacted by the “Cine Miercoles”

campaign in Spain, with across-the-board

ticket price reductions on Wednesdays, and

“Actions jeunes” in France, a campaign offering

discounts on film tickets to the under 14s.

22

KINEPOLIS GROUP

ANNUAL REPORT 2014

03 / MANAGEMENT REPORT