15. Trade receivables and other assets

Non-current other receivables

IN ’000 €

2014

2015

Cash guarantees

958

1 051

Other receivables

11 698

10 794

TOTAL

12 656

11 845

IN ’000 €

2014

2015

Trade receivables

19 620

26 497

Taxes receivable, other than income taxes

1 335

1 421

Deferred charges and accrued income

81

80

Tax shelter receivables

576

168

Tax shelter investments

391

318

Other receivables

2 290

4 508

TOTAL

24 293

32 992

The non-current other receivables entirely relate to

the sector-related government grants that can be

The rise in the trade receivables primarily relate to expansion

in combination with a strong rise in sales of the busi-

ness-to-business activities in the fourth quarter.

The tax shelter receivables concern the loans made to third

parties to finance and support the film production in Belgium.

The tax shelter investments concern the film rights the Group

acquires as part of tax shelter transactions.

obtained in France from the CNC based on the number of

visitors.

The other current receivables primarily consist of the current

portion of the French sector-related government grants (CNC)

for € 2.7 million (2014: € 1.7 million) and a current account

with Utopolis Belgium of € 1.3 million.

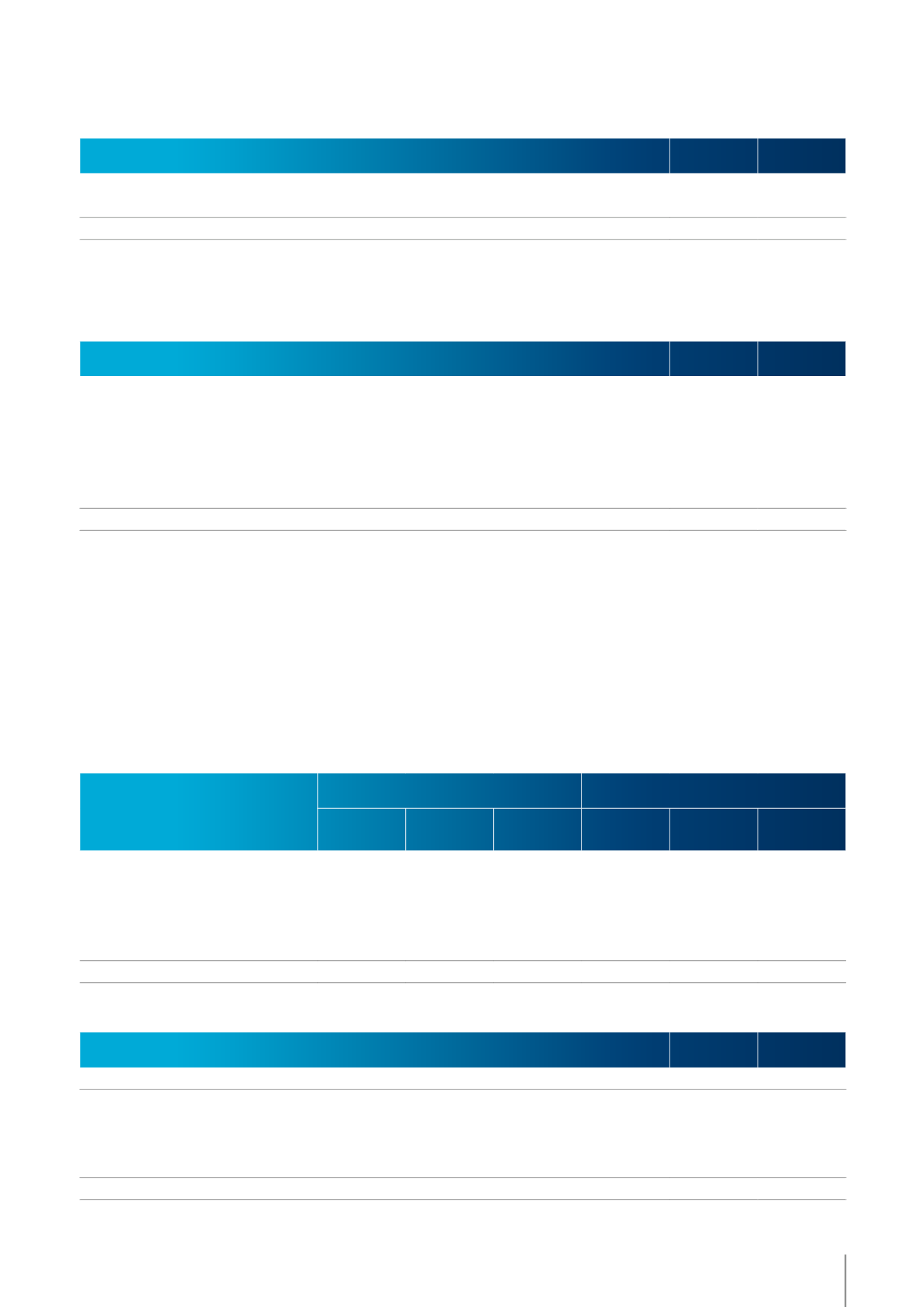

Current trade receivables and other assets

IN ’000 €

2014

2015

GROSS

CARRYING

AMOUNT

IMPAIRMENT

NET

CARRYING

AMOUNT

GROSS

CARRYING

AMOUNT

IMPAIRMENT

NET

CARRYING

AMOUNT

Not yet due on reporting date

32 538

-2

32 536

39 120

-13

39 107

Less than 30 days past due

3 236

-61

3 175

3 837

-13

3 824

Between 31 and 120 days past due

920

-39

881

1 523

60

1 583

Between 120 days and 1 year past due

1 180

-930

250

718

-626

92

Over 1 year past due

847

-740

107

1 142

-910

232

TOTAL

38 721

-1 772

36 949

46 340

-1 502

44 838

Ageing of the non-current and current trade receivables and other assets

Movement in the allowance for impairment of trade receivables

IN ’000 €

2014

2015

BALANCE AT END OF PREVIOUS PERIOD

-1 833

-1 772

Recognized impairments

-673

-449

Utilized impairments

279

10

Reversed impairments

451

709

Effect of exchange rate fluctuations

4

BALANCE AT END OF CURRENT PERIOD

-1 772

-1 502

95

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2015