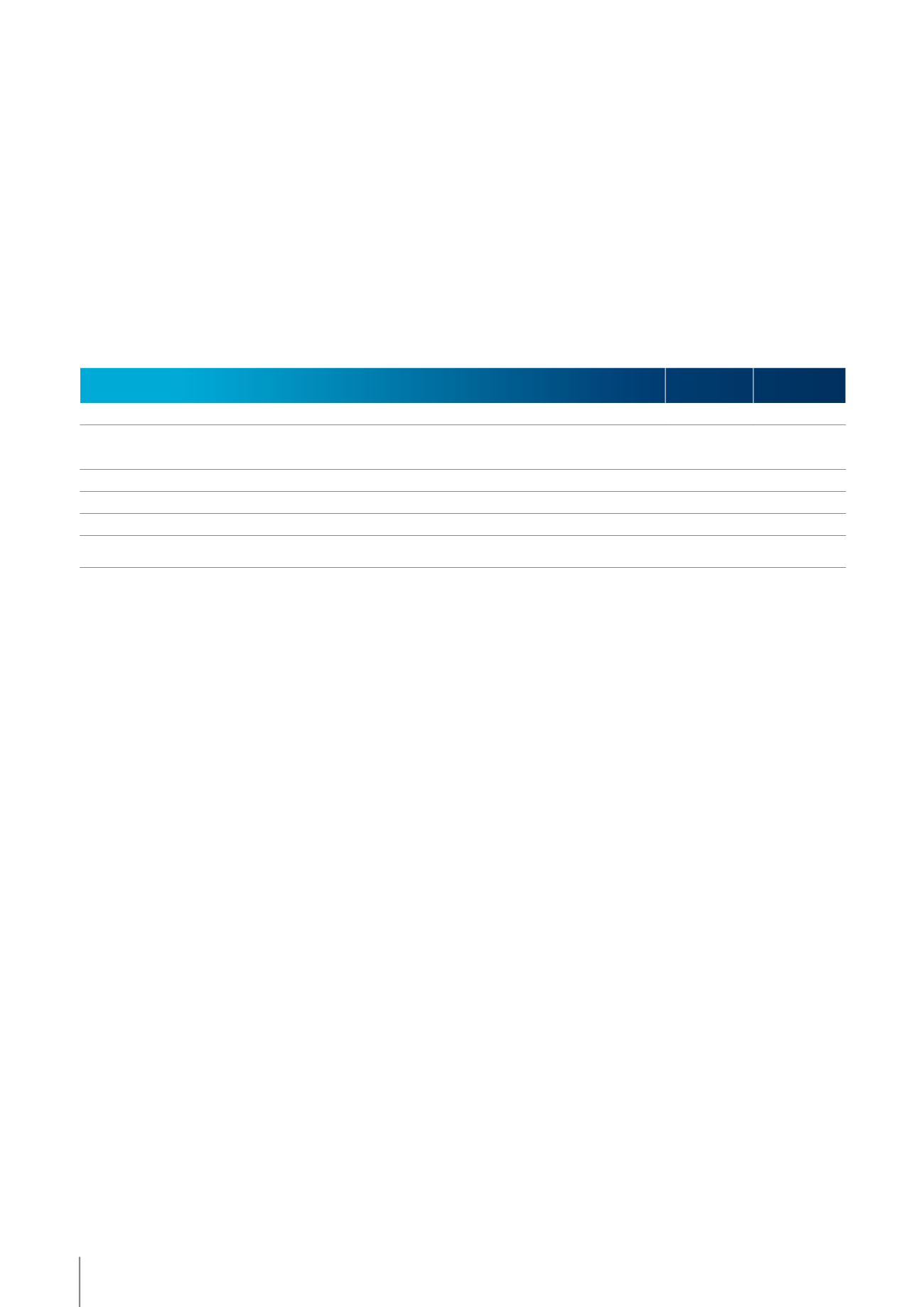

IN ’000 €

MÉGAROYAL

UTOPOLIS

NET IDENTIFIABLE ASSETS AND LIABILITIES

4 567

22 785

Cash (1)

12 500

32 192

Contingent considerations

REMUNERATION

12 500

32 192

GOODWILL

7 933

9 407

Acquired cash (2)

844

6 328

ACQUISITION OF SUBSIDIARIES, NET OF ACQUIRED CASH,

IN THE STATEMENT OF CASH FLOWS

(1) - (2)

11 656

25 864

Goodwill calculation and reconciliation with the consolidated statement of cash flows

This goodwill is not tax-deductible.

Mégaroyal’s property, plant and equipment primarily relate to

the Bourgoin cinema complex.

€ 20.6 million of the property, plant and equipment of

Utopolis relate to the cinema complexes in Kirchberg

(Luxembourg), Longwy (France), Zoetermeer, Emmen and Oss

(The Netherlands). The nominal value of the trade receivables

of the Utopolis group on the acquisition date was € 1.1 million.

€ 0.0 million of this was deemed uncollectable. A € 4.7 million

provision was recognized with regard to the unfavorable

lease on the Almere (The Netherlands) cinema complex.

The current financial liability was immediately paid after

the transaction date and replaced by an internal loan.

The total of the acquired cash of Mégaroyal is

€ 0.8 million, comprising cash and cash equivalents

(€ 0.2 million), a term deposit (€ 1.9 million) and an

outstanding loan that was repaid immediately after

the acquisition (€ 1.3 million).

Acquisitions 2014

The following acquisitions occurred in 2014:

★

★

Acquisition of the Spanish Abaco Cinebox and Abaco

Alcobendas complexes;

★

★

Acquisition of the Dutch Wolff Bioscopen group.

The Spanish complexes Abaco Cinebox (Alicante) and Abaco

Alcobendas (Madrid) were included in the consolidation scope

of the Group in April 2014 and June 2014 Goodwill was

€ 0.5 million.

The Wolff Bioscopen group was acquired on 22 July 2014.

A fixed consideration of € 10.6 million was paid. At 31

December 2014 the fair value of the contingent considera-

tions was € 4.2 million. The inclusion of the Wolff Bioscopen

group in the consolidation scope of the Group on 22 July 2014,

the date on which control was acquired, resulted in goodwill

of € 16.9 million. The origin of this goodwill is the targeted

visitor potential of the existing cinema and the new-build

projects in Dordrecht and Utrecht (The Netherlands).

On 1 July 2015 the municipality of Utrecht issued the

permit for building and operating a new complex in

Utrecht Jaarbeurs. The permit was ratified by the Council

of State in The Netherlands.

At 31 December 2015 the fair value of the contingent

considerations was € 1.3 million. At 7 July 2015, € 2.7 million

was paid to the former shareholders of the Wolff Bioscopen

group. The change in fair value of the contingent considera-

tion was € 0.2 million and was deducted from goodwill.

The fair value of the contingent considerations was deter-

mined on the basis of the following assumptions:

★

★

The number of visitors of the new future cinema in

Utrecht (The Netherlands) in the third year after opening;

★

★

The two existing complexes in Utrecht and the

complexes in Nieuwegein (The Netherlands) and

Rotterdam (The Netherlands) will continue to be leased

during the agreed term.

For more information about the fair value of the contingent

considerations, see note 24.

90

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2015