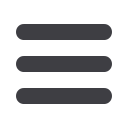

IN ’000 €

2014

2015

CARRYING

AMOUNT

FAIRVALUE

CARRYING

AMOUNT

FAIRVALUE

Private placement of bonds – fixed interest rate

96 000

100 368

Public bond – fixed interest rate

75 000

83 459

75 000

81 622

Interest-bearing loans – variable interest rate

46 000

46 000

41 600

41 600

Lease liabilities – fixed interest rate

15 104

15 203

11 993

12 157

Bank overdrafts

470

470

43

43

Transaction costs refinancing

-538

-538

-1 879

-1 879

TOTAL

136 036

144 594

222 757

233 911

The fair value of the public bond with fixed interest rate

(level 2) was measured by discounting the future cash flows

based on an interest rate of 2.20% for the part of the bond

with a maturity date in 2019 and 3.18% for the part of the

bond with a maturity date in 2023 (2014: 2.33%).

The fair value of the private bond with fixed interest rate

(Level 2) was measured by discounting the future cash flows

based on an interest rate of 2.53% for the bond with a term

of 7 years and 1.94% for the part of the bond with a term of

10 years.

An interest rate of 2.09% for the leased projectors and 3.18%

for the leased complex in Groningen (The Netherlands) was

used to measure the fair value of the lease liabilities (Level 2)

by discounting the future cash flows (2014: 2.32% for the

leased projectors; 3.31% for the leased complex).

The fair value of the other non-derivative financial assets

(loans and receivables) and liabilities (measured at amortized

cost) is equal to the carrying amount.

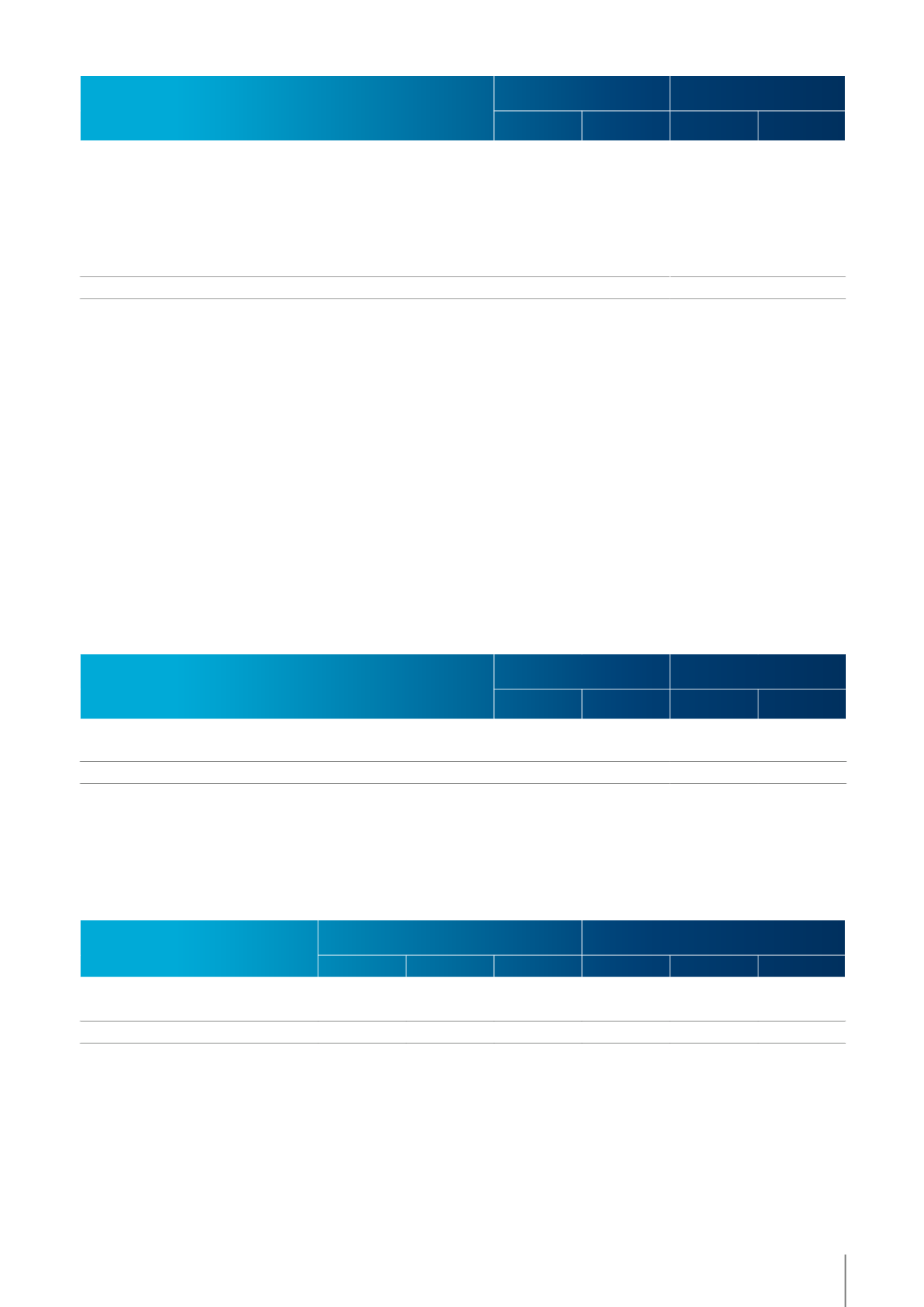

The following table gives the nominal or contractual amounts

and the clean fair value of all outstanding derivative financial

instruments (cash flow hedging instruments). The nominal or

contractual amounts reflect the volume of the derivative

financial instruments outstanding at the balance sheet date.

As such they represent the Group’s risk on these transactions.

AMOUNTS IN ’000 € UNLESS STATED OTHERWISE

2014

2015

NOMINALVALUE IN

’000 $

FAIR

VALUE

NOMINALVALUE IN

’000 $

FAIR

VALUE

Foreign currency

Foreign exchange forward contracts

1 200

27

2 000

64

TOTAL

1 200

27

2 000

64

At 31 December 2015 there were no outstanding interest rate

swaps. The fair value of foreign exchange forward contracts is

calculated as the discounted value of the difference between

the value of these contracts based on the exchange rate at

the balance sheet date and the contract value based on the

forward exchange rates at the same date.

The fair value of the derivative financial instruments is included in the Group’s statement of financial position as follows:

IN ’000 €

2014

2015

ASSETS

LIABILITIES

NETVALUE

ASSETS

LIABILITIES

NETVALUE

Non-current

Current

27

27

64

64

TOTAL

27

27

64

64

At 31 December 2015 the fair value of the contingent

considerations was € 1.3 million. This amount was

determined on the basis of the following assumptions:

★

★

The number of visitors of the new future complex in

Utrecht (The Netherlands) in the third year after opening;

★

★

The two existing complexes in Utrecht and the

complexes in Nieuwegein (The Netherlands) and

Rotterdam (The Netherlands) will continue to be leased

during the agreed term.

107

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2015