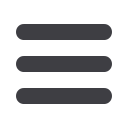

Hedging activities

The Group uses derivative financial instruments to hedge the

interest rate risk. All derivative financial instruments are

measured at fair value. The following table gives the remai-

ning term of the outstanding derivative financial instru-

ments at closing date. The amounts given in this table are

the notional amounts.

IN ’000 $

2015

< 1YEAR

1-5YEARS

> 5YEARS

TOTAL

Foreign currency

Foreign exchange forward contracts

2 000

2 000

IN ’000 $

2014

< 1YEAR

1-5YEARS

> 5YEARS

TOTAL

Foreign currency

Foreign exchange forward contracts

1 200

1 200

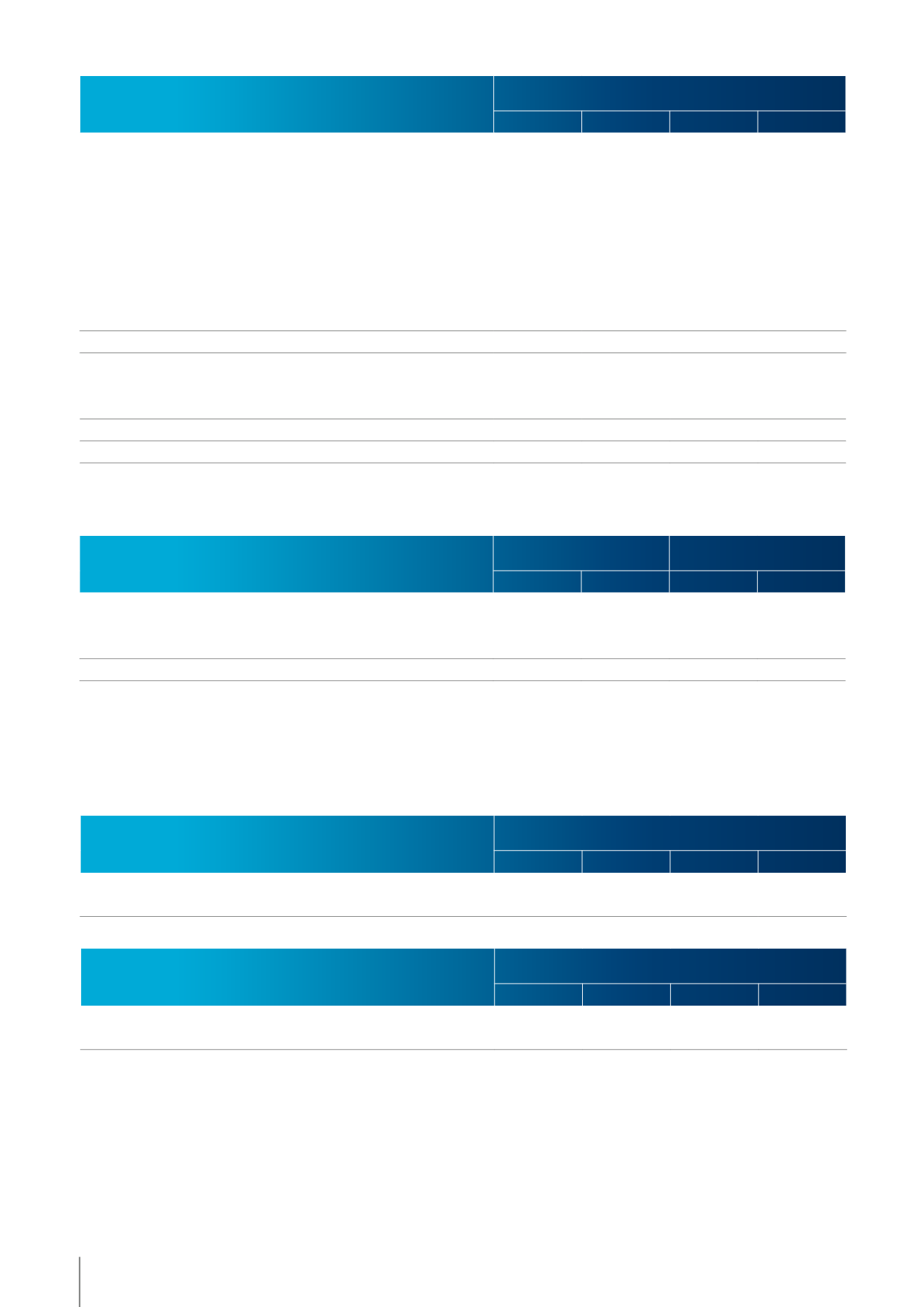

Fair value

Fair value is the amount at which an asset can be traded or a

liability settled in an orderly transaction between well-infor-

med, willing parties, following the ‘arm’s length’ principle.

The following table discloses the clean fair value and the

carrying amount of the main interest-bearing financial loans

and borrowings (measured at amortized cost).

IN ’000 €

2014

2015

TOTAL

< 1YEAR

TOTAL

< 1YEAR

Loans and borrowings with credit institutions

5 000

5 000

41 600

5 949

Bank overdrafts

470

470

43

43

Commercial Paper

41 000

41 000

TOTAL

46 470

46 470

41 643

5 992

In respect of interest-bearing loans and borrowings with a variable interest rate, the following table shows the periods in which

they reprice.

IN ’000 €

2014

< 1YEAR

1-5YEARS

> 5YEARS

TOTAL

Bond

3 563

89 250

92 813

Trade payables

52 181

52 181

Commercial Paper

41 000

41 000

Lease liabilities

3 437

6 477

8 270

18 184

Loans and borrowings with credit institutions

51

5 104

5 155

Contingent considerations

4 159

4 159

Tax shelter liabilities

460

460

Bank overdrafts

470

470

Third party current account payables

43

43

Non-derivative financial liabilities

105 364

100 831

8 270

214 465

Foreign exchange forward contracts

- Outflow

959

959

- Inflow

-988

-988

Derivative financial liabilities

-29

-29

TOTAL

105 335

100 831

8 270

214 436

106

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2015