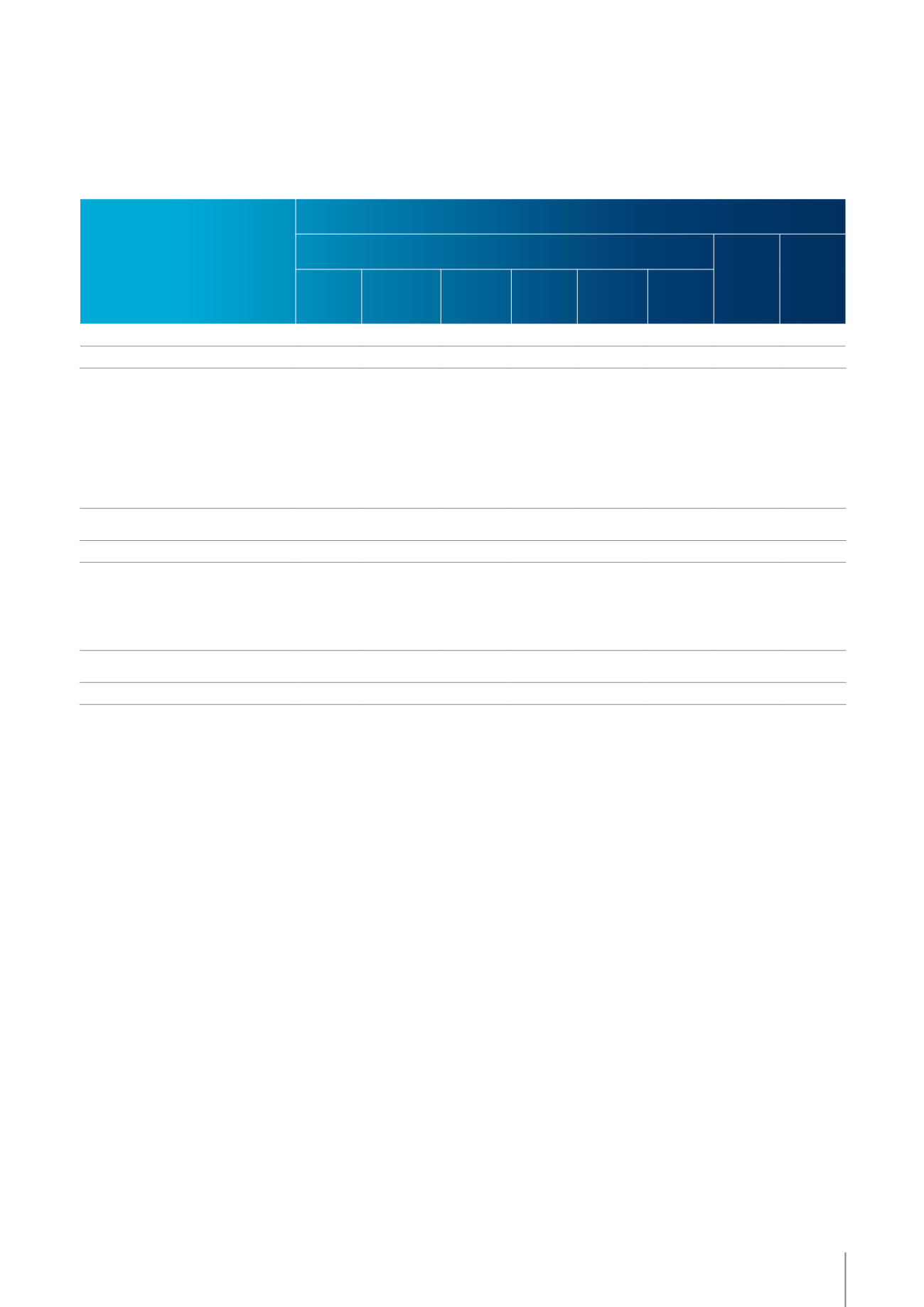

The notes on page 58-111 are fully part of these consolidated financial statements.

IN ’000 €

2013

ATTRIBUTABLE TO OWNERS OF THE COMPANY

NON-

CONTROL-

LING

INTERESTS

EQUITY

SHARE

CAPITAL

AND SHARE

PREMIUM

TRANSLATION

RESERVE

HEDGING

RESERVE

TREASURY

SHARES

RESERVE

SHARE-

BASED

PAYMENTS

RESERVE

RETAINED

EARNINGS

AT 31 DECEMBER 2012

20 106

-1 188

-409 -8 876

2 493 96 542

108 668

Profit for the period

37 541

37 541

Items that are ormay be reclassified to

profit or loss:

Translation differences

-393

-393

Cash flow hedges – effective portion

of changes in fair value

84

84

Cash flow hedges – net change in the

fair value reclassified to profit or loss

480

480

Taxes on other comprehensive income

-194

-194

Other comprehensive income

for the period, net of tax

-393

370

-23

Total comprehensive income

-393

370

37 541

37 518

Dividends

-13 085

-13 085

Own shares acquired / sold

-28 478

-146

-28 624

Cancellation of treasury shares

28 538

-28 538

Share-based payment transactions

104

77

181

Total transactions with owners,

recorded directly in equity

60

104 -41 692

-41 528

AT 31 DECEMBER 2013

20 106

-1 581

-39 -8 816

2 597 92 390

104 657

57

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2014