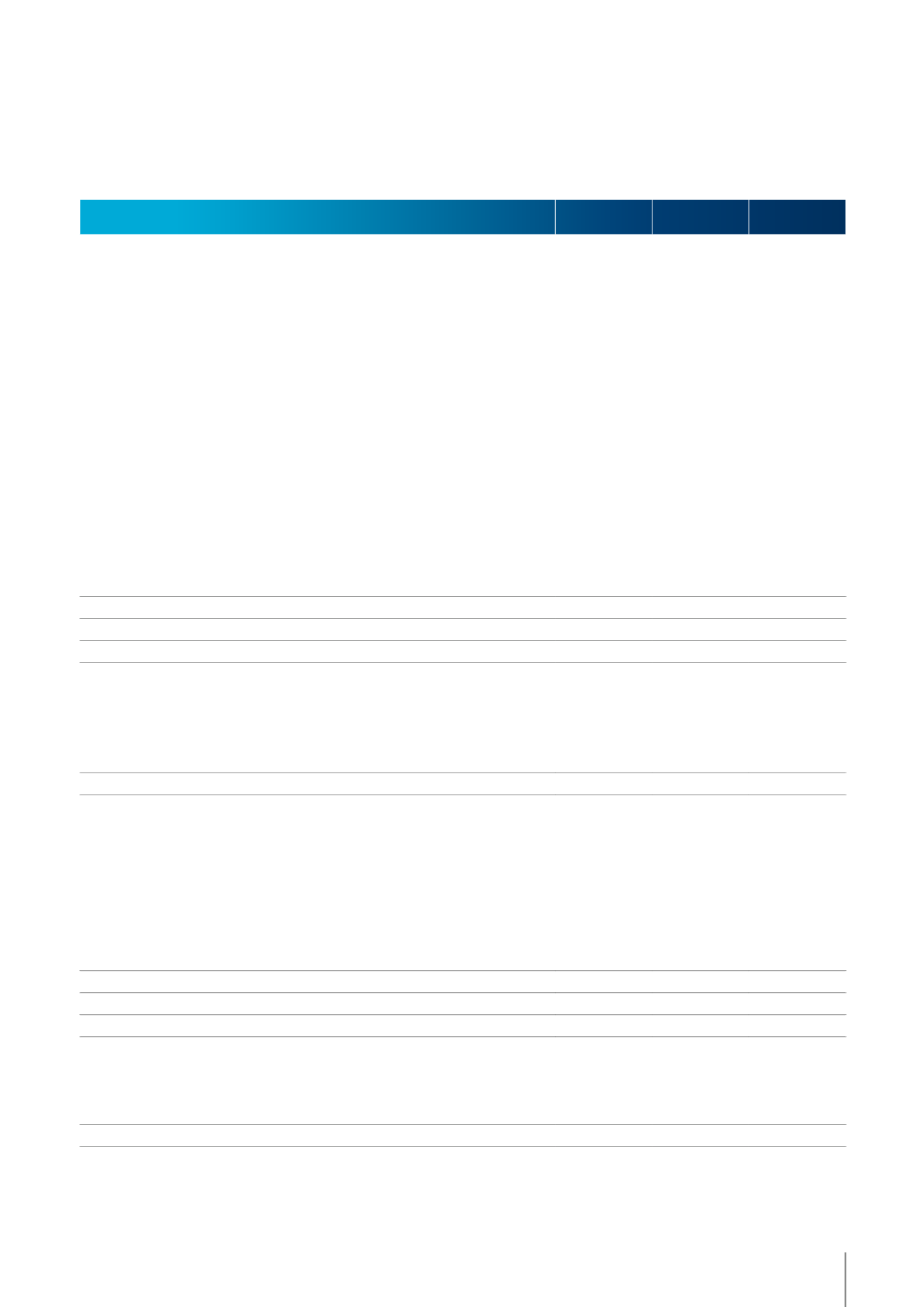

Consolidated statement of cash flows

at 31 December

The notes on page 58-111 are fully part of these consolidated financial statements.

IN ’000 €

NOTE

2013

2014

Profit before tax

49 071

46.370

Adjustment for:

Depreciation and amortization

6

20 005

21 322

Provisions and impairments

-68

-684

Government grants

4

-664

-649

(Gains) Losses on sale of fixed assets

4

-909

-14

Change in fair value of derivative financial instruments and unrealized foreign

exchange results

-9

38

Change in fair value of contingent considerations

7, 10, 24

-1 359

Unwinding of non-current receivables

7, 22

-731

-696

Share-based payments

5

181

389

Impairment on tax shelter investments

7

539

433

Amortization of transaction costs refinancing

209

209

Interest expenses and income

7

4 851

4 313

Change in inventory

-193

-176

Change in trade and other receivables

-2 130

3 154

Change in trade and other payables

-1 980

2 803

Cash from operating activities

68 172

75 453

Income taxes paid

-9 239

-11 321

Net cash from operating activities

58 933

64 132

Acquisition of other intangible assets

9

-951

-2 169

Acquisition of property, plant and equipment and investment property

11, 12

-11 086

-30 570

Acquisition of subsidiaries, net of cash acquired

10

-10 468

Proceeds from sale of property, plant and equipment

1 851

293

Net cash used in investing activities

-10 186

-42 914

Capital reduction

-8

-5

New loans

102 641

102 000

Repayment of borrowings

-114 998

-85 589

Interest paid

-4 873

-4 325

Interest received

21

12

Repurchase and sale of own shares

-28 459

-18 657

Dividends paid

-13 096

-16 846

Net cash used in financing activities

-58 772

-23 410

NET CASH FLOW

-10 025

-2 192

Cash and cash equivalents at beginning of the period

16

28 785

18 712

Cash and cash equivalents at end of the period

16

18 712

16 530

Effect of exchange rate fluctuations on cash held

-48

10

NET CASH FLOW

-10 025

-2 192

55

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2014