346 540

(2)

options were granted to the Chairman

(1)

and each

of the CEOs in 2008. In 2009 management staff were

granted 150 000 options, 75 000 in 2010 and 237 500 in

2011. In 2012 no options were granted, but 39 000 options

forfeited that were not yet permanently acquired.

No options were granted in 2013 either, but 48 675 options

forfeited that were not yet permanently acquired and

70 000 options were exercised. In 2014, 125 000 options

were granted and 30 000 options exercised.

At 31 December 2014, 1 426 245 granted options were still

outstanding.

Given that the granting of the share options is not based on

individual or company performance, they are not consid-

ered to be part of the variable remuneration as defined in

the Companies Code.

A further description of the characteristics of these options

is provided in Note 20 to the Consolidated Financial

Statements.

Fiscal years 2015-2016

On the proposal of the Nomination and Remuneration

Committee, and with due consideration for the benchmark

data from an external survey, the Board of Directors has

decided to adopt the remuneration policy and the remunera-

tion of the Executive Management for the fiscal years

2015-2016 in order to bring the policy more into line with

practice at other comparable listed companies with regard to

the ratio of the fixed to the variable part of the remuneration

package and to keep the remuneration in line with market

rates, bearing in mind the roles, responsibilities, management

targets and value created.

Given the long-term improvement in the results of the

existing core business, the important steps taken in the

implementation of the expansion strategy and the great

value created for all stakeholders by the Executive

Management in recent years, the Board of Directors has

decided:

★

★

to increase the fixed remuneration of bvba Eddy

Duquenne from € 428 242

(3)

to € 538 242 and to reduce

the variable remuneration of maximum € 295 000 and

the “outperformance” bonus of maximum € 165 000 to a

variable remuneration of maximum € 400 000; the

annual expense allowance of € 9 000 is unchanged.

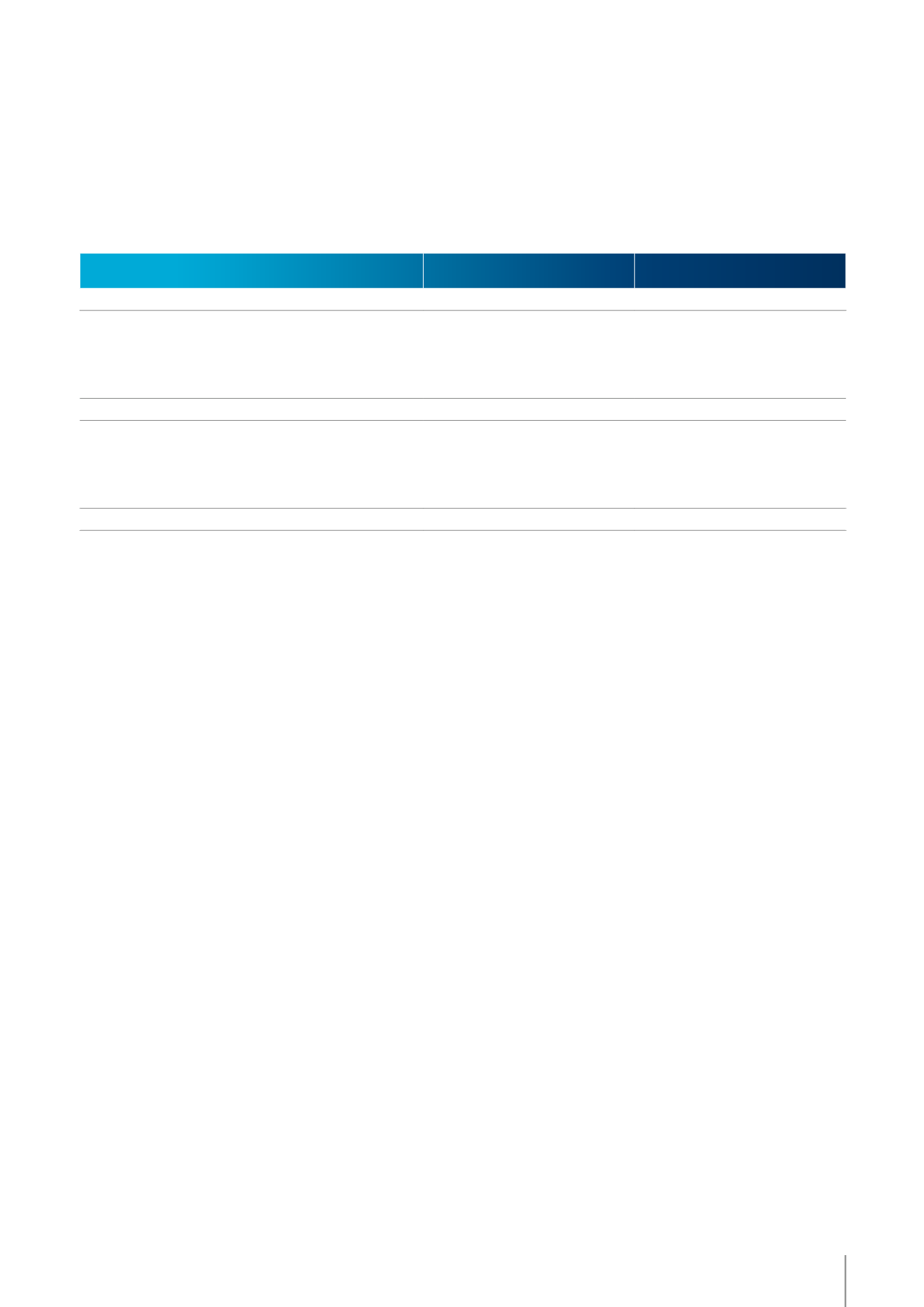

NAME

REMUNERATION

AMOUNTS (EXCL. VAT) (IN €)

CEO

Eddy Duquenne bvba

Fixed remuneration

(1)

428 242

(4)

Variable remuneration

(2)

295 000

“Outperformance” bonus

(2)

125 000

Expense allowance

9 000

TOTAL

857 242

Joost Bert

Fixed remuneration

(1)

330 120

(4)

Variable remuneration

(2)

215 000

“Outperformance” bonus

(2)

0

Pension scheme

(3)

10 422

TOTAL

555 542

(1) Other than remuneration received as a member of the Board of Directors (which amounts to € 30 000 for each director).

(2) Received in 2014 for performances in 2013.

(3) Mr. Joost Bert participates in a supplementary pension scheme providing for an annual indexed fixed contribution.

(4) Since the financial year 2014 Executive Management no longer charges car costs but the fixed compensation was raised in a tax-neutral manner at a corresponding indexed amount to

compensate for this.

(1) In his former capacity of Executive Director.

(2) The number at that time multiplied by five, with due consideration for the 2014 share split.

(3) Since the fiscal year 2014 the Executive Management no longer charges on car costs. Instead, the fixed remuneration has been increased by a corresponding indexed amount.

37

KINEPOLIS GROUP

ANNUAL REPORT 2014

03 / MANAGEMENT REPORT