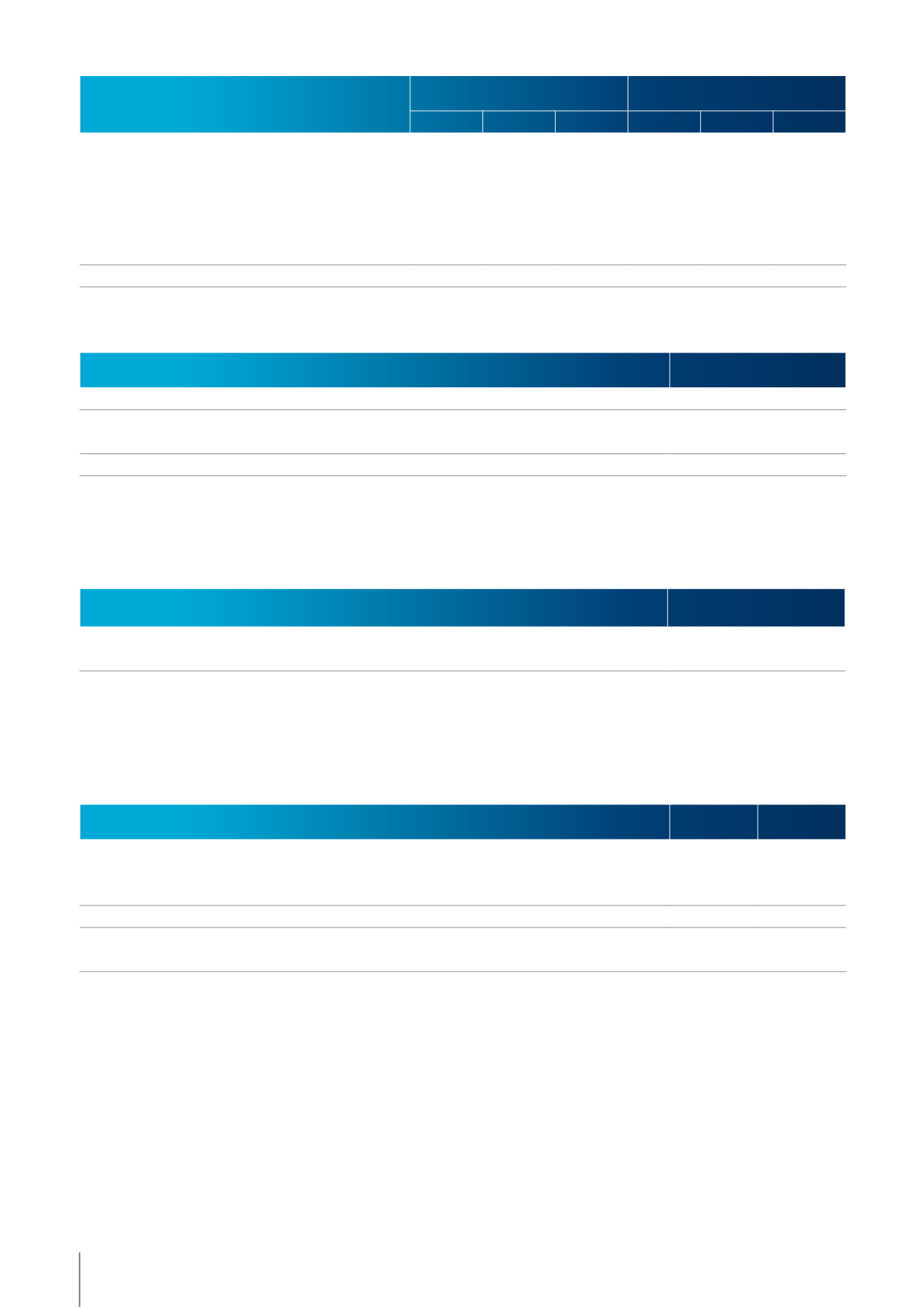

Level 3 fair value

The following table shows the reconciliation between the opening and closing balance for the level 3 fair value:

Level 3 fair value sensitivity analysis

IN ’000 €

CONTINGENT

CONSIDERATIONS

BALANCE AT END OF PREVIOUS PERIOD

Acquisitions through business combinations (see Note 10)

5 519

Change in fair value (unrealized) (part of the finance income) (see Note 7)

-1 359

BALANCE AT END OF CURRENT PERIOD

4 159

IN ’000 €

2014

10% increase in the projected number of visitors of the future cinema in Utrecht

535

10% decrease in the projected number of visitors of the future cinema in Utrecht

-535

25. Operating leases

Leases as lessee

Non-cancellable operating lease rentals are payable as follows:

IN ’000 €

2013

2014

Less than one year

4 525

7 515

Between one and five years

13 038

24 316

More than five years

10 653

20 720

TOTAL

28 216

52 551

Minimum lease payments in the income statement with regard to operating leases

4 855

6 164

Contingent lease payments in the income statement with regard to operating leases

199

247

The multiplex in Valencia (Spain) is leased for a period of

40 years since May 2001. There is an option to terminate

the contract after 20 years. The contract does not provide

for a purchase option.

The Group also leases the complex in the centre of Nîmes

(France) and a complex in the centre of Liège (Belgium).

The term of these leases is nine years (renewable).

A fixed rent is always charged.

The Group also leases the land on which a number of

complexes have been built and the adjacent car park for a

remaining period of 11 years (renewable) in Belgium and

49 years in France (long lease construction). The paid rent is

partly fixed and partly variable, based on the number of

tickets sold. This variable rent was € 0.2 million in 2014.

A number of car parks are also leased in Belgium for a

period of 1 to 27 years (renewable). A fixed rent is always

charged.

IN ’000 €

2013

2014

LEVEL1

LEVEL2

LEVEL3

LEVEL1

LEVEL2

LEVEL3

Cash flow hedging – Interest

Interest rate swaps

-31

Cash flow hedging – Currency

Foreign exchange forward contracts

-29

27

Financial liabilities measured at fair value

Contingent considerations

4 159

TOTAL

-60

27

4 159

The possible change in the significant non-observable input

stated below could reasonably have the following impact

on the fair value of the contingent considerations at balance

sheet date:

102

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2014