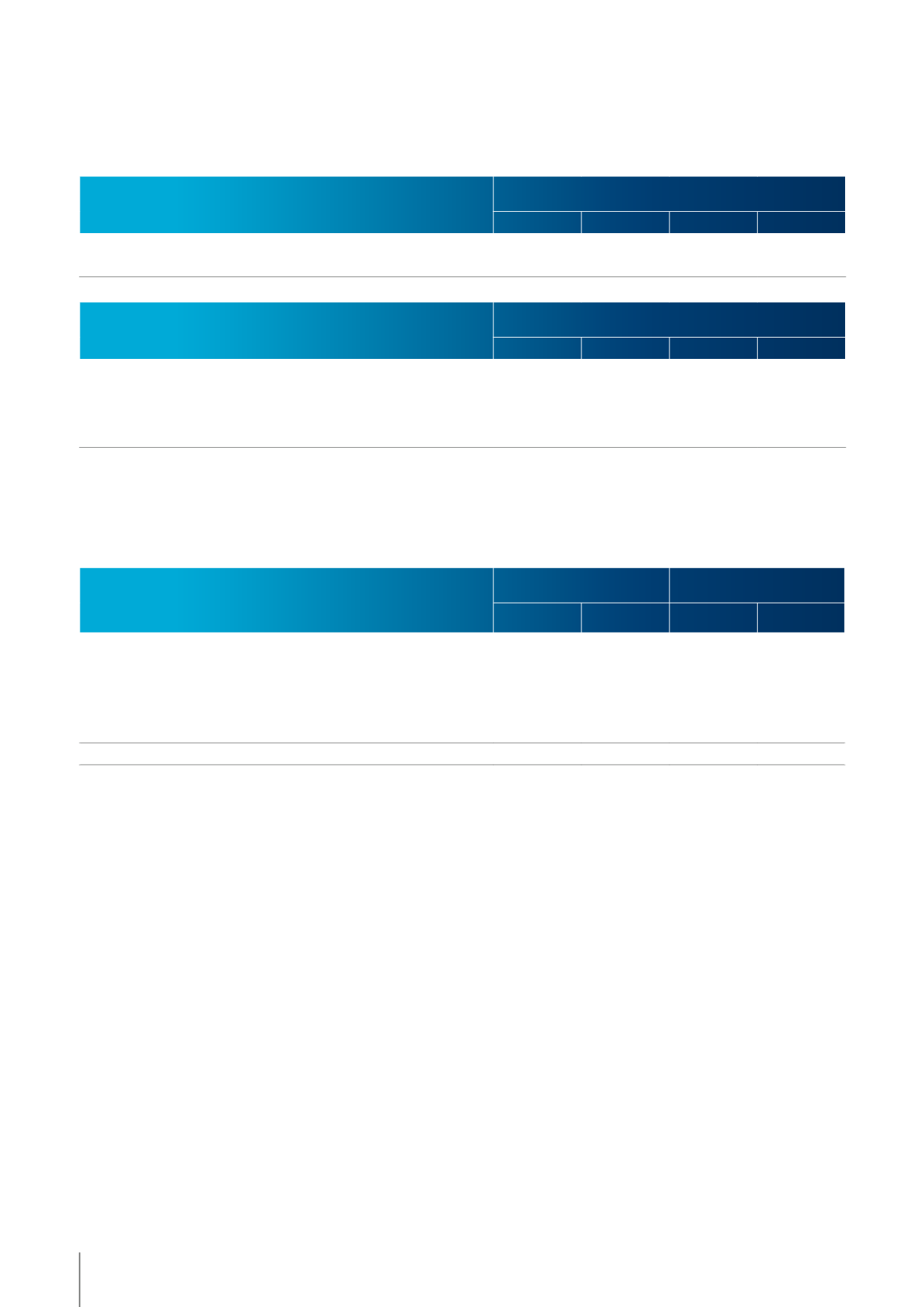

Hedging activities

The Group uses derivative financial instruments to hedge

the interest rate and currency risk. All derivative financial

instruments are measured at fair value. The following

table gives the remaining term of the outstanding

derivative financial instruments at closing date. The

amounts given in this table are the notional amounts.

IN ’000 €

2014

< 1YEAR

1-5YEARS

> 5YEARS

TOTAL

Foreign currency

Foreign exchange forward contracts

1 200

1 200

IN ’000 €

2013

< 1YEAR

1-5YEARS

> 5YEARS

TOTAL

Interest

Interest rate swaps

5 000

5 000

Foreign currency

Foreign exchange forward contracts

1 800

1 800

Fair value

Fair value is the amount at which an asset can be traded

or a liability settled between well-informed, willing parties,

following the “arm’s length” principle.

The following table discloses the clean fair value and the

carrying amount of the main interest-bearing financial

loans and borrowings (measured at amortized cost).

IN ’000 €

2013

2014

CARRYING

AMOUNT

FAIRVALUE

CARRYING

AMOUNT

FAIRVALUE

Public bond – fixed interest rate

75 000

79 128

75 000

83 459

Transaction costs refinancing

-747

-747

-538

-538

Lease liabilities – fixed interest rate

7 996

8 060

15 104

15 203

Interest-bearing loans – variable interest rate

25 000

25 000

46 000

46 000

Bank overdrafts

581

581

470

470

TOTAL

107 830

112 022

136 036

144 594

The fair value of the public bond with fixed interest rate

was measured by discounting the future cash flows based

on an interest rate of 2.33% (2013: 3.71%).

An interest rate of 2.32% for the leased projectors and

3.31% for the leased cinema in Groningen (the Netherlands)

was used to measure the fair value of the lease liabilities by

discounting the future cash flows (2013: 3.13% for the

leased projectors).

The fair value of the other non-derivative financial assets

(loans and receivables) and liabilities (measured at amor-

tized cost) is equal to the carrying amount.

The following table provides the nominal or contractual

amounts and the clean fair value of all outstanding deriva-

tive financial instruments (cash flow hedging instruments).

The nominal or contractual amounts reflect the volume of

the derivative financial instruments outstanding at the

balance sheet date. As such they represent the Group’s risk

on these transactions.

100

05 / FINANCIAL REPORT

KINEPOLIS GROUP

ANNUAL REPORT 2014